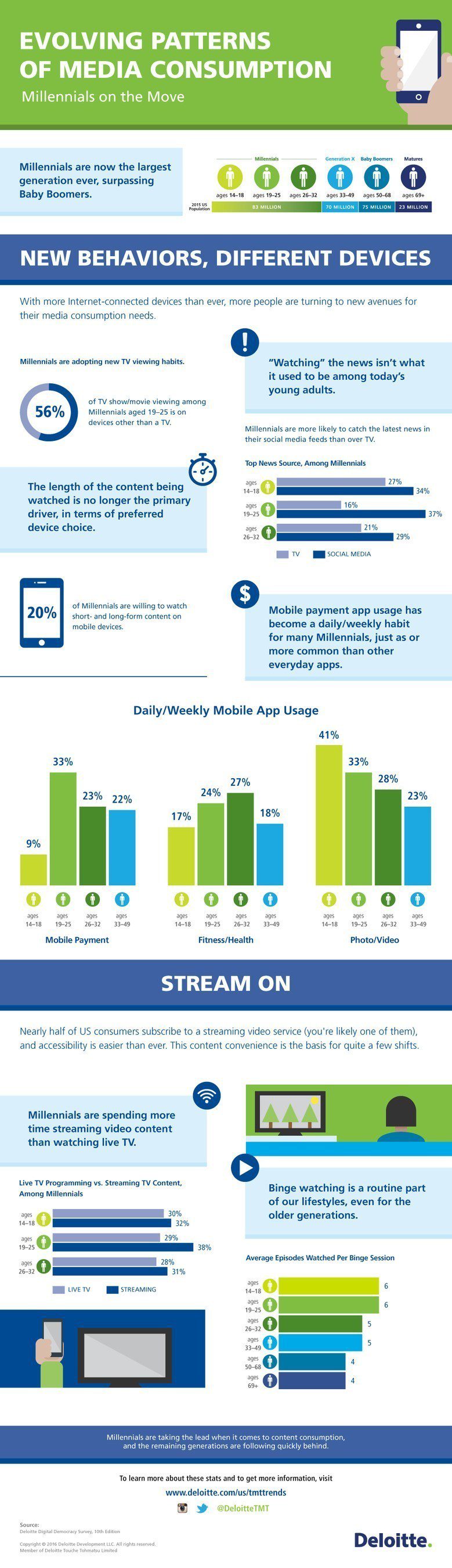

Has America become a marathon nation when it comes to video content consumption? Indications point to “yes.” Seventy percent of U.S. consumers now binge watch an average of five episodes at a time, and almost one-third (31 percent) binge on a weekly basis according to Deloitte’s 10th “Digital Democracy Survey.” In addition to binge watching, nearly half (or 46 percent) of Americans now subscribe to streaming video services, with millennials aged 14-25 spending more time streaming video content than watching live television.

Additional binge watching and streaming media findings from the survey include:

– More than half of all consumers, and three-quarters of millennials, watch movies and TV shows via streaming on at least a monthly basis.

– Millennials aged 26-32 who currently pay for streaming video have an average of three subscriptions.

– Millennials aged 14-25 value their streaming video subscriptions more than pay TV subscriptions.

Over one-third of baby boomers aged 50-68 (35 percent) who binge watch TV do so once a week, and average four episodes per sitting.

– Over half (53 percent) of U.S. consumers who binge watch choose television dramas.

– The percentage of streaming subscribers who ranked the service among their top three most valued subscriptions has tripled in the last three years (61 percent today, up from 17 percent in 2012).

“The proliferation of online content shows no signs of slowing down and the consumer appetite to consume content is equally voracious,” said Gerald Belson, vice chairman and U.S media and entertainment sector leader, Deloitte Consulting LLP. “The survey data indicates that consumers are more willing than ever to invest in services to watch whenever, wherever and on whatever device they choose.”

Highlighting Americans’ preferences for entertainment devices, Deloitte’s “Digital Democracy Survey” examines emerging behaviors across generations, specifically millennials, who are setting new benchmarks for how much media content is consumed and paving the way for older generations to follow. The survey also looks at the value consumers place on products and services; as well as attitudes and behaviors towards advertising and social networks, and mobile technologies. It includes influencers of consumer buying decisions, and how consumers are using their devices. Among the findings are:

Purchase Decisions Influenced More by Non-Traditional Advertising Sources

– Nearly 3 in 4 millennials aged 19-32 are more influenced in their buying decisions by social media recommendations than TV ads.

– Of millennials aged 19-25, 71 percent indicated that their buying decisions are influenced by online reviews from people they do not know, which is higher than the number who are influenced by TV ads.

– More than one-third of consumers under age 50 and nearly half of millennials say their buying decisions are influenced by an endorsement from an online personality.

Social Media’s Real-Life Impact

– Social media sites have surpassed television as the most popular source of news for millennials.

– Two-thirds of millennials say they value their time interacting with friends on social media sites as much as their time spent in-person.

– Eighty five percent of U.S. consumers are currently on social media and 58 percent check their social networks daily.

If You Don’t Multitask When You Watch TV, You’re in the Minority

– More than 90 percent of U.S. consumers are now multitasking while watching TV.

– Millennials admitted to engaging in an average of four additional activities while watching TV, primarily surfing the Internet, using social networks and text messaging.

– Thirty three percent of all consumers typically browse the web while watching TV.

– Fewer than one-quarter of consumers’ multitasking activities are directly related to the program being watched, indicating that second screen activities have yet to realize their full potential.

“The on-the-go, always-connected consumer is driving cultural changes in content consumption that fundamentally impact how companies connect with and engage consumers,” added Kevin Westcott, principal and U.S. media and entertainment consulting leader, Deloitte Consulting LLP. “These behavioral changes combined with the shift towards mobile-based consumer experiences are disrupting traditional business models — while at the same time paving the way for newer opportunities for technology, media and entertainment companies to adapt and evolve for the next generation.”

The “Digital Democracy Survey” was fielded by an independent research firm from Nov. 5-19, 2015 and employed an online methodology among 2,205 U.S. consumers. All data is weighted back to the most recent U.S. census to give a representative view of what consumers are doing. For more information on the U.S. edition of Deloitte’s “Digital Democracy Survey,” please visit www.deloitte.com/us/tmttrends.